Streamlining Mortgage Data Flow: Gesa Credit Union’s Integrated Systems Success

Context & Profile Gesa Credit Union, headquartered in Richland, Washington, is the second-largest credit union in the state with over 305,000 members...

Information Security Compliance

Add security and compliance to Microsoft 365

BI Reporting Dashboards

Realtime pipeline insights to grow and refine your learning operation

Integrations for Banks & Credit Unions

Connect LOS, core platforms, and servicing system

Productivity Applications

Deploy customized desktop layouts for maximum efficiency

Server Hosting in Microsoft Azure

Protect your client and company data with BankGrade Security

4 min read

Justin Kirsch : Sep 8, 2025 3:33:45 PM

Credit Union West is a Glendale, Arizona-based credit union with roughly 90,000 members and over $1.2 billion in assets. Founded in 1951 on Luke Air Force Base, the institution has a long history of serving its community and prides itself on providing top-notch member service. To maintain this standard, efficient internal processes are critical. As the credit union expanded, it identified a need to modernize how mortgage data flowed between its lending and core banking systems. Specifically, Credit Union West wanted to seamlessly connect its loan origination system (MortgageFlex ONE) with its core banking platform (Jack Henry’s Symitar Episys) to eliminate bottlenecks in the mortgage process.

Prior to integration, Credit Union West’s staff had to manually enter and update loan information in both the MortgageFlex system and the Symitar core. This redundant data entry not only slowed down operations but also introduced opportunities for errors and inconsistencies whenever a loan moved from the origination platform into the core banking system. For example, after a mortgage closed in the LOS, employees would re-key all relevant details into Symitar for servicing and member account records, delaying post-closing processes and risking input mistakes. Such “swivel-chair” work was inefficient and detracted from the team’s ability to focus on member-facing activities. The credit union needed a solution to integrate the two systems in real time, ensuring data accuracy and freeing staff from tedious manual tasks.

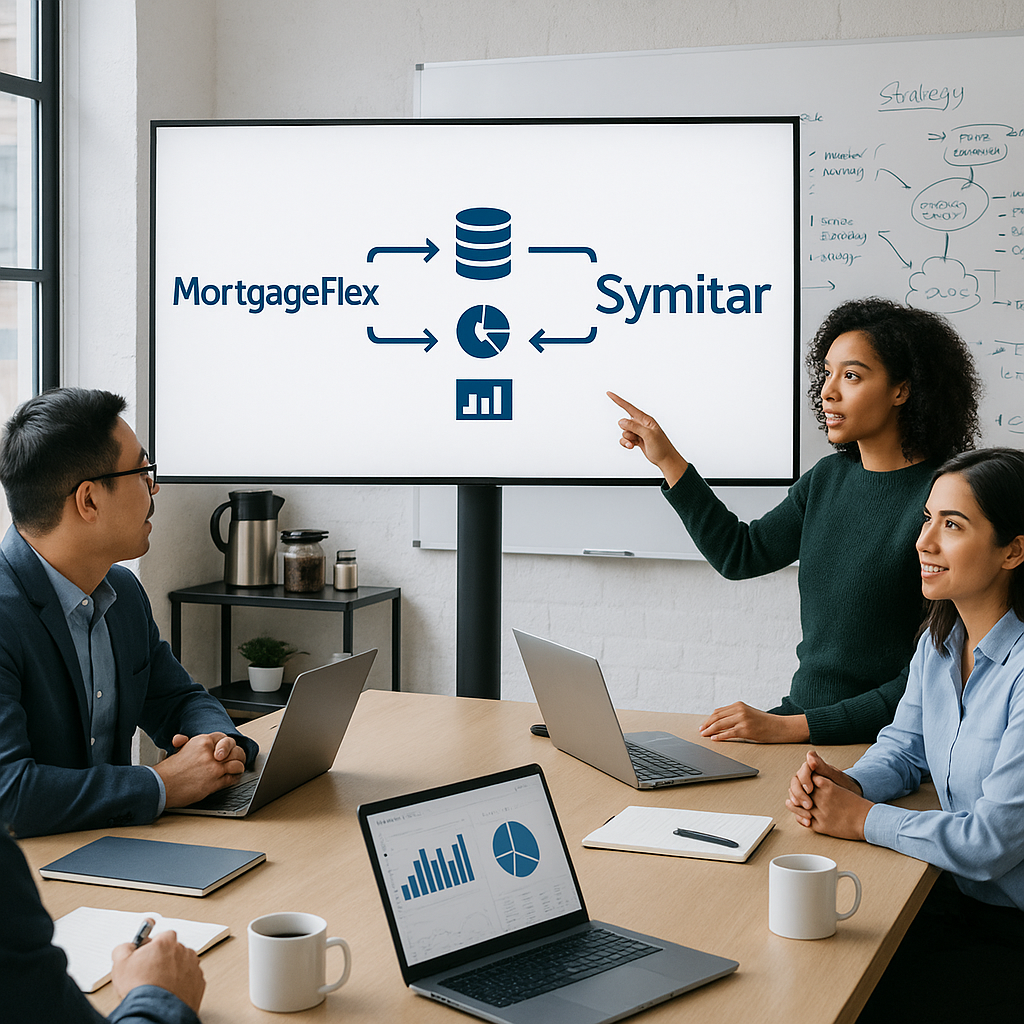

Credit Union West turned to MortgageExchange – a cloud-managed integration platform from Mortgage Workspace – to bridge the gap between Symitar and MortgageFlex. The MortgageExchange solution established a direct, rules-based connection that allowed the core and LOS to communicate and share data in real time. This integration effectively automated the transfer of mortgage information between the two systems, eliminating the need for any manual re-entry. Critically, the interface was set up as a bi-directional link, so updates in either system would automatically propagate to the other without any staff intervention.

MortgageExchange delivered real-time, bi-directional data exchange between Symitar and MortgageFlex, meaning that as soon as data was entered or changed in one system, it was reflected in the other. The platform is a cloud-managed service, which reduced the burden of on-premises servers and custom coding for the credit union. MortgageExchange uses secure, mortgage-native connectors that leverage each system’s API (or a custom adapter where needed), ensuring a seamless fit with both the core and LOS. All sensitive data is encrypted in transit and at rest for security. Furthermore, the integration is maintained by the provider – if a vendor software update threatens to disrupt the interface, the MortgageExchange team updates the connector proactively to keep data flowing without interruption. The result is a worry-free interface that is secure, scalable, and built for the mortgage industry’s unique needs. By following industry standards and validation rules, MortgageExchange also supports regulatory compliance, ensuring data integrity and consistency across systems.

With MortgageExchange in place, Credit Union West now enjoys hassle-free data synchronization between its MortgageFlex LOS and Symitar core. The integration has completely ended the drudgery of dual data entry, significantly cutting down processing delays and virtually eliminating input errors in loan records. Notably, post-closing efficiency has dramatically improved – when a mortgage loan is funded in MortgageFlex, the loan details are instantly available in Symitar for servicing and accounting. There is no lag waiting for back-office updates; a new loan entered in the LOS instantly reflects in the core system, accelerating the boarding of loans into the portfolio. This real-time update capability has removed timing discrepancies and ensures that both systems are always in sync.

The operational impact of these changes is substantial. Credit Union West’s staff have reclaimed countless hours that were once spent on redundant data entry and correcting errors. Those time savings have been redirected toward member-facing activities and loan growth initiatives. By streamlining the mortgage boarding process, the credit union can serve its members faster and more accurately – for example, new accounts and loan payments are set up without delay or mistakes, improving the overall member experience. In short, the MortgageExchange integration translated into significant time and cost savings for Credit Union West, while also enhancing data accuracy and compliance. The credit union reports that the project has ultimately helped them deliver better, more efficient service to their members.

Credit Union West’s integration success story illustrates the power of a purpose-built data exchange platform in the credit union space. By deploying MortgageExchange to connect its MortgageFlex ONE LOS with its Symitar core, the credit union achieved more than just a technical interface – it gained a strategic advantage. The solution’s real-time, bidirectional data flow and rules-based automation have improved productivity, reduced risk, and supported superior member service. Just as importantly, MortgageExchange’s cloud-managed, scalable architecture means the integration will continue to operate reliably as the credit union grows, with no need for additional hardware or manual updates when systems change. This future-proof approach, combined with secure data handling and industry-standard compliance support, gives Credit Union West confidence that their mortgage operations can evolve without missing a beat.

In an era where digital efficiency is key, Credit Union West has demonstrated how leveraging MortgageExchange can transform back-office processes and drive better outcomes for both the institution and its members. The elimination of manual entry and the gains in accuracy and speed underscore a simple truth: when core banking and lending systems work in unison, everyone – staff and members alike – benefits.

Context & Profile Gesa Credit Union, headquartered in Richland, Washington, is the second-largest credit union in the state with over 305,000 members...

When Closing Day Wasn’t the End For members, closing on a mortgage should feel like the finish line. At CFCU Community Credit Union, it often felt...

For members, closing day feels like the finish line. But inside a credit union, it’s often the beginning of a long post-closing checklist: pushing...