Stop Re-Keying Loan Data

Eliminate duplicate entries across LOS, core, servicing, and CRM. Speed up onboarding and reduce costly errors.

Information Security Compliance

Add security and compliance to Microsoft 365

BI Reporting Dashboards

Realtime pipeline insights to grow and refine your learning operation

Integrations for Banks & Credit Unions

Connect LOS, core platforms, and servicing system

Productivity Applications

Deploy customized desktop layouts for maximum efficiency

Server Hosting in Microsoft Azure

Protect your client and company data with BankGrade Security

Eliminate duplicate entries across LOS, core, servicing, and CRM. Speed up onboarding and reduce costly errors.

Protect member data with encryption in transit and at rest. Built for regulatory confidence and audit readiness.

Connect seamlessly with LOS, core, and servicing systems through pre-built APIs designed for credit union workflows.

Middleware and scripts weren’t built for the complexity of mortgage lending. From limited connectors to fragile fixes and compliance gaps, they create more risk than they solve. Credit unions need an integration platform designed specifically for mortgage workflows.

Off-the-shelf tools don’t have deep integrations for mortgage systems like LOS, servicing, or imaging.

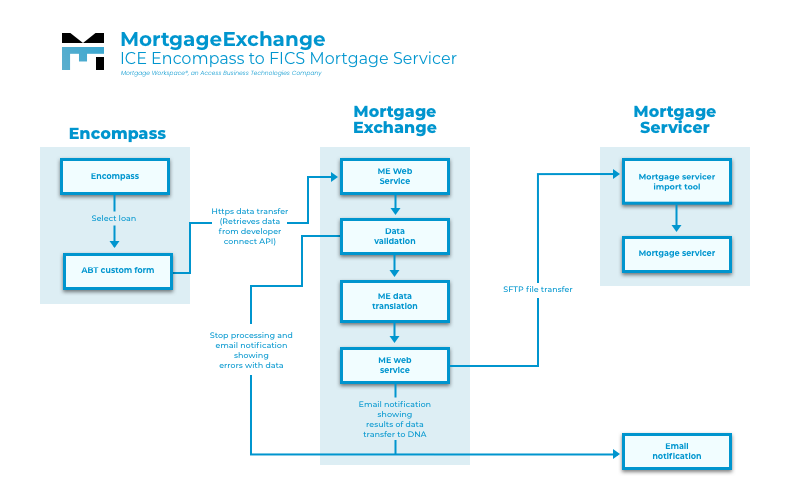

MortgageExchange comes with pre-built connectors designed specifically for mortgage data. It syncs LOS, core, servicing, imaging, and CRM systems so information flows securely and automatically.

Scripts and bots often break with vendor updates, leaving staff scrambling to patch processes.

MortgageExchange replaces breakable scripts with stable, supported integrations. When vendors update their platforms, your data flows continue uninterrupted.

Generic platforms miss mortgage-specific fields and reporting, creating audit and regulatory risk.

MortgageExchange tracks mortgage-specific fields and audit trails that generic tools miss. It gives examiners the clarity they expect and your credit union the protection it needs.

Big vendors only integrate within their own ecosystems, leaving credit unions stuck in silos.

MortgageExchange works across multiple vendors and systems, so your credit union isn’t trapped in one ecosystem. You stay flexible while still automating the entire process.

MortgageExchange connects seamlessly with the platforms credit unions rely on most — LOS, core banking, servicing, CRM, and imaging. With pre-built, mortgage-specific integrations, data stays consistent, duplicate entry disappears, and accuracy improves across your enterprise.

MortgageExchange doesn’t just streamline loan origination—it solves the hardest part: moving closed-loan data into your core and servicing systems. Credit unions see fewer manual corrections, cleaner audits, faster loan boarding, and happier staff.

Once mappings are verified, MortgageExchange transfers loan, escrow, and GL data

Validated data across LOS, core, and servicing platforms improves compliance and reduces risk.

Loans move from LOS to core/servicing in hours instead of days, with fewer manual steps.

Teams spend less time fixing data and more time serving members and growing relationships.

Purpose-built modules automate loan boarding, escrow, GL posting, and more. Credit unions choose the modules that match their workflows, while MortgageExchange keeps data consistent across all systems.

Moves all first-lien mortgage data into the core banking system fields automatically, ensuring loan records are accurate and consistent from day one.

Automatically creates member records in the core system for borrowers not already on file, reducing onboarding friction.

Transfers origination fees and other financial entries from the LOS into the correct GL accounts with accuracy and control.

Populates all escrow and impound details from the loan into the core’s escrow fields, ensuring payments and balances are always accurate.

Sends funding information from the LOS to your wire transfer platform, ensuring disbursements are error-free and compliant.

Manages draw schedules and interest reserves, feeding data into the core or project management systems for accuracy and visibility.

Together these modules create an end-to-end pipeline—moving post-close data from LOS to core, GL, escrow, and servicing systems with zero re-keying. The diagram below shows how it flows in action.

MortgageExchange automates the transfer of mortgage data from one platform to another—no onsite servers, fragile scripts, or manual maintenance. Our pre-built connectors integrate securely with mortgage, core banking, servicing, CRM, and other systems via APIs or SDKs, so your team can focus on members, not data entry.

Access Business Technologies (ABT) is the largest Microsoft Azure–certified Tier 1 Cloud Solution Provider (CSP) focused on the mortgage industry. More than 750 credit unions, community banks, non-depository mortgage lenders, and brokers rely on ABT to secure, integrate, and scale their mortgage operations. With over 20 years of mortgage technology experience and a proven track record of regulatory compliance, post-close automation, and cloud security, we deliver trusted solutions credit unions and banks can depend on.

MortgageExchange helps credit unions and banks cut IT costs by eliminating manual data entry, removing the need for onsite servers, and reducing reliance on fragile custom scripts or RPA bots. As a cloud-managed service, it delivers predictable monthly pricing and measurable ROI—so you get enterprise-grade automation without enterprise overhead.

Every MortgageExchange implementation includes the Core Loan Data Sync foundation module that moves closed-loan data with 100% accuracy from your LOS into core and servicing systems. From there, credit unions and banks can extend the platform with optional modules for member creation, GL posting, escrow and impounds, wire transfers, HELOCs, construction loans, imaging & documents, CRM sync, financial reporting, and custom integrations.

This modular approach ensures you always have a reliable foundation while giving you the flexibility to tailor MortgageExchange to your institution’s unique workflows, compliance needs, and future growth.

The Core Loan Data Sync module is the foundation of MortgageExchange. It automatically transfers all first-lien mortgage data from your LOS into your core banking and servicing systems with 100% accuracy on mapped fields.

This eliminates duplicate entry, reduces manual corrections, and ensures loan records are always consistent across platforms. The Core includes audit-ready field validation, secure data transfer, and compliance logging—so your credit union or bank can trust the integrity of every record.

The New Member Creation module automatically creates borrower records in the core system when members don’t already exist. This ensures borrowers and co-borrowers are onboarded accurately without requiring manual keying after loan closing.

By linking new members directly to their loans, this module improves compliance, streamlines servicing, and saves operations teams valuable time. It also ensures that statements, payments, and regulatory reports are tied to the correct member account.

The General Ledger Posting module posts loan-level financial data directly from the LOS into your GL. It maps LOS financial fields to GL accounts, reducing reconciliation errors and helping teams close the books faster.

With consistent mappings and validations, accruals, fees, and adjustments flow accurately into the ledger—improving audit readiness and month-end efficiency.

The Escrow & Impounds module transfers escrow setup data from the LOS into your core and servicing systems so property taxes, insurance, and other reserves are established correctly from day one.

This reduces manual fixes and ensures payment schedules, analyses, and disclosures remain accurate across systems.

Wire Transfer Automation sends funding instructions directly from your LOS to your core banking system. This eliminates duplicate entry of funding data, speeds closing timelines, and reduces the risk of mis-keyed transactions.

With consistent hand-offs and validations, funds are authorized and posted correctly the first time.

The HELOC & Second Loans module accounts for line structures and amortization differences, automating data exchange for advances, paydowns, and balance changes so LOS, core, and servicing remain synchronized.

That consistency helps teams service revolving products accurately and keep disclosures current.

The Construction Loans module automates draw schedules, inspections, and balance updates so activity reflects accurately in both LOS and servicing systems without manual re-entry.

Teams get fewer exceptions and more consistent reporting throughout the build cycle.

Imaging & Documents automatically delivers closing packages and loan documents into your imaging system with consistent naming, indexing, and metadata.

MortgageExchange maps LOS fields to imaging categories so teams don’t re-key, and members see accurate records from day one.

The CRM Sync module keeps member and loan data aligned between LOS/servicing and your CRM for accurate outreach and reporting. Automating this sync eliminates stale records and mismatched contacts so marketing and member services stay in step.

Financial Reporting integrates transaction-level loan and servicing data with your financial systems to improve accuracy and compliance.

Executives gain timely visibility into performance instead of waiting for batch reports—supporting faster, data-driven decisions.

Custom Integrations extend MortgageExchange into your unique systems and workflows. If the target system exposes an API, SDK, file export, or secure database access, we can usually connect it and operationalize the flow.

This preserves your core platform while unlocking automation across edge tools and internal systems.

From discovery to deployment, we guide your credit union or bank through every step. In just three stages, you’ll go from manual re-keying to automated, 100% accurate post-close data transfers.

Share your LOS, core, and servicing systems. We’ll map out your data flows and identify where errors and duplicate entry happen today.

Our team configures and verifies field mappings, runs test transfers, and ensures compliance and audit-readiness before going live.

Enjoy worry-free, 100% accurate transfers of loan, escrow, GL, and member data between systems—with no re-keying required.

“Affinity Plus FCU revolutionized data management by integrating Encompass with Symitar, eliminating duplicate entry and manual corrections while delivering faster, more accurate loan boarding.”

Affinity Plus Federal Credit Union

Systems: Encompass (LOS) ↔ Symitar (Core)

Read the case study →

Effortless Integration: How Affinity Plus FCU Revolutionized Data Management with MortgageExchange

“Chevron FCU connected Blue Sage, Symitar, and Servicing Director through MortgageExchange, breaking down data silos and delivering faster, more accurate loan onboarding.”

Chevron Federal Credit Union

Systems: Blue Sage (LOS) ↔ Symitar (Core) ↔ Servicing Director (Servicing)

Read the case study →

Overcoming Data Silos: How Chevron FCU Built a Core-Connected Ecosystem

“First Citizens Bank bridged the LOS–servicing gap by integrating Empower with Phoenix, eliminating manual corrections and ensuring fast, accurate loan boarding that improves compliance and efficiency.”

First Citizens Bank

Systems: Empower (LOS) ↔ Phoenix (Servicing)

Read the case study →

Bridging the LOS–Servicing Gap: First Citizens Bank’s Empower–Phoenix Integration Boosts Efficiency

“Patelco CU broke the mortgage data bottleneck by integrating Encompass with Fiserv DNA, eliminating manual re-entry and ensuring accurate, compliant loan data that accelerates closings and improves member service.”

Patelco Credit Union

Systems: Encompass (LOS) ↔ Fiserv DNA (Core)

Read the case study →

Breaking the Mortgage Data Bottleneck: Patelco Credit Union’s Integration Success

“By connecting Mortgage Cadence LFC with Fiserv DNA and Dovenmuehle, Gesa Credit Union eliminated duplicate entry, sped up loan boarding, and kept servicing and core records in real-time sync for cleaner audits and better member service.”

Gesa Credit Union

Systems: Mortgage Cadence LFC (LOS) ↔ Fiserv DNA (core) ↔ Dovenmuehle (DMI) Servicing

Read the case study →

Streamlining Mortgage Data Flow: Gesa Credit Union’s Integrated Systems Success

“Thrivent FCU brought four systems together into one orchestrated flow, eliminating re-keying and ensuring accurate, compliant loan data that saves staff time and improves member experience.”

Thrivent Federal Credit Union

Systems: Mortgage Cadence (LOS) ↔ Fiserv DNA (Core) ↔ Symitar (Core) ↔ Servicing

Read the case study →

Thrivent FCU: From Four Great Systems to One Orchestrated Flow

“Tower FCU unified Mortgage Cadence with Symitar to eliminate duplicate entry and reduce errors, creating faster loan boarding and stronger compliance with less back-office strain.”

Tower Federal Credit Union

Systems: Mortgage Cadence (LOS) ↔ Symitar (Core)

Read the case study →

All Systems Go: How Tower FCU Unified Its Mortgage Systems

“Desert Financial CU created an oasis of efficiency by integrating Mortgage Cadence with Fiserv DNA, removing manual re-entry and accelerating loan boarding with audit-ready accuracy.”

Desert Financial Credit Union

Systems: Mortgage Cadence (LOS) ↔ Fiserv DNA (Core)

Read the case study →

Oasis of Efficiency: Desert Financial’s Seamless Mortgage Integration Journey

“By integrating Mortgage Cadence with Symitar, One Nevada CU eliminated duplicate entry and sped up loan boarding, freeing staff to focus on member service with audit-ready accuracy.”

One Nevada Credit Union

Systems: Mortgage Cadence (LOS) ↔ Symitar (Core)

Read the case study →

One Nevada Credit Union: Uniting Systems for a Seamless Mortgage Experience

“Desert Financial streamlined post-closing by integrating Mortgage Cadence with Fiserv DNA, eliminating manual re-entry and ensuring accurate, timely loan boarding that strengthens compliance and member service.”

Desert Financial Credit Union

Systems: Mortgage Cadence (LOS) ↔ Fiserv DNA (Core)

Read the case study →

Oasis of Efficiency: Desert Financial’s Seamless Mortgage Integration Journey

“Bay FCU streamlined post-closing by connecting Empower with Fiserv DNA and WireXchange, eliminating duplicate entry and ensuring fast, accurate, and compliant loan data transfers.”

Bay Federal Credit Union

Systems: Empower (LOS) ↔ Fiserv DNA (Core) ↔ WireXchange (Servicing/Settlement)

Read the case study →

How Bay Federal Credit Union Streamlined Post-Closing with MortgageExchange

“AllSouth FCU broke down silos by integrating Mortgage Cadence with Fiserv DNA, eliminating re-keying and reducing costly errors while delivering faster, more accurate loan boarding.”

AllSouth Federal Credit Union

Systems: Mortgage Cadence (LOS) ↔ Fiserv DNA (Core)

Read the case study →

Breaking Down Silos: How AllSouth FCU Streamlined Mortgages with Integration

“1st MidAmerica CU integrated Mortgage Cadence with FICS Servicing, eliminating duplicate entry and manual corrections while ensuring accurate, audit-ready loan data that speeds up post-closing.”

1st MidAmerica Credit Union

Systems: Mortgage Cadence (LOS) ↔ FICS (Servicing)

Read the case study →

Case Study for 1st MidAmerica Credit Union Using MortgageExchange

“CFCU Community CU connected Mortgage Cadence with Fiserv DNA, eliminating double entry and delays while ensuring faster, more accurate loan boarding.”

CFCU Community Credit Union

Systems: Mortgage Cadence (LOS) ↔ Fiserv DNA (Core)

Read the case study →

Closing the Loop: How CFCU Community Credit Union Fixed Its Mortgage Data Disconnect

“ComFed automated LOS-to-servicing with MortgageExchange, ending duplicate entry and cutting post-closing bottlenecks while improving accuracy and compliance.”

Communication Federal Credit Union

Systems: Mortgage Cadence (LOS) ↔ TruHome Servicing

Read the case study →

Cracking the Post-Closing Bottleneck: How ComFed Streamlined Loan Boarding with MortgageExchange

“Lafayette FCU linked Corelation KeyStone with Calyx Path, eliminating manual re-entry and ensuring real-time, accurate mortgage records across systems.”

Lafayette Federal Credit Union

Systems: Calyx Path (LOS) ↔ Corelation KeyStone (Core)

Read the case study →

Lafayette Federal Credit Union Integrates Corelation Keystone and Calyx Path with MortgageExchange

Explore answers to the most common questions about MortgageExchange — organized by topic to help your team (and search engines) find the right details quickly. Everything here is visible, crawlable, and written to build confidence with AI and human readers alike.

How MortgageExchange connects to your systems, how long projects take, and what effort is required from your team.

Yes. We build each interface based on your connection requirements. Most integrations use an API (application programming interface) or an SDK (software development kit). If needed, we can also connect via secure database access or file exchanges (e.g., SFTP). As long as a system provides a supported way to connect, we can build the interface.

A typical MortgageExchange project takes about 90 days. Timelines depend on scope, system complexity, and SME availability. We always build in a development sandbox first, then push to production after thorough testing and approval.

No problem. Project plans are flexible. If your priorities shift, we can pause or re-sequence milestones so you don’t lose progress and your team can focus where needed.

Your SMEs join for requirements, mapping validation, and final testing. Our engineers handle the heavy lifting, minimizing your team’s workload while keeping you fully informed.

All changes are built and tested in a development/test environment first. After validation and approval, we promote them to production — ensuring accuracy and compliance with minimal disruption.

We accommodate post-deployment enhancements. Changes are scoped, built, and tested in dev first. You’re billed for the actual development time needed to implement and validate new features.

Virtually any loan, member, or servicing data. Common flows include LOS data, core banking records, servicing updates, imaging/documents, and CRM member data. If a system exposes data via API, SDK, secure DB, or file exchange, we can map and automate it.

Yes. MortgageExchange is built for modern API connectivity. We connect to fintech platforms, analytics tools, digital banking add-ons, and REST/GraphQL APIs, keeping your LOS and core in sync as you adopt new solutions.

Absolutely. MortgageExchange is modular but highly adaptable. We can add custom mappings, logic, or even new modules to align with your compliance rules and operational workflows.

How MortgageExchange protects member data, supports audits, and manages changes without disrupting operations.

Yes. MortgageExchange uses end-to-end encryption, role-based access controls, and audit logging. Hosting in Microsoft Azure supports adherence to GLBA, FFIEC guidelines, and SOC 2 practices.

All transfers use TLS/SSL encryption, API tokens/keys, and role-based permissions. Sensitive fields can be encrypted at rest, and all exchanges are logged for auditing.

Every integration includes audit-ready logs that show what data moved, when, and to which system. These reports support internal audits, regulatory exams, and quick resolution of exceptions.

We monitor vendor releases, apply changes in the dev environment, and validate with your team before promoting to production. This ensures seamless continuity with minimal disruption.

Automation eliminates human error and duplicate entry. Validations keep data accurate, consistent, and compliant across LOS, core, servicing, and CRM — reducing audit issues and member friction.

Hosted in a redundant cloud environment with backups and failover. If disruptions occur, integrations can be restored quickly — aligned with your BCP/DR plans.

ABT provides SLAs for availability and response. Azure cloud hosting supports 99.9% uptime standards, redundancy, and proactive monitoring for enterprise-grade reliability.

How MortgageExchange keeps pace as your institution scales, consolidates, and improves member outcomes.

Yes. MortgageExchange scales with members, branches, and transaction volume. You can layer additional modules as needs evolve without replacing your foundation.

MortgageExchange is used by credit unions, community banks, and mortgage lenders that need to connect LOS, core, servicing, imaging, and CRM systems while eliminating manual work.

By mapping and synchronizing data across different cores, LOS, and servicing systems, MortgageExchange smooths consolidation of member records and portfolios during M&A.

By keeping systems in sync, members receive accurate statements, balances, and online access from day one — fewer errors, faster service, and higher satisfaction.

ABT has over 20 years delivering mortgage/credit-union technology with thousands of projects completed. We’re a Tier 1 Microsoft CSP with deep LOS, core, and servicing integration experience.

What happens after go-live — hosting, environments, licensing, training, ROI, and why a managed platform beats DIY.

ABT manages hosting and support — monitoring, updates, patches, and troubleshooting — so your staff can focus on members. Our Microsoft CSP relationship adds enterprise support escalation when needed.

MortgageExchange is hosted in Microsoft Azure for security, scale, redundancy, and certifications that outpace typical on-prem setups — while reducing infrastructure overhead.

We build with separate development, test, and production environments. Changes are validated in dev/test first, then promoted to production to protect live data and ensure integrity.

As a Tier 1 Microsoft CSP & Premier Support partner, ABT provides direct licensing, billing, and escalation — backing your project with enterprise-grade support and access to Microsoft resources.

A modular subscription: start with the Core Loan Data Sync foundation and add optional modules as needed. Pricing reflects number of interfaces, complexity, and support requirements, so you scale cost with value.

ABT provides hands-on training, documentation, and coaching. We guide your team through requirements, mapping, testing, and go-live with step-by-step support and ongoing consultation.

Most clients see ROI within the first year via reduced manual entry, fewer compliance exceptions, faster closings, and improved efficiency — often saving more than the subscription cost.

MortgageExchange is a managed integration platform, not a brittle connector. You get modular building blocks, audit trails, compliance logging, and ongoing support — built to scale and endure.

DIY often lacks scalability, auditability, and vendor support, leaving fragile code to maintain. MortgageExchange delivers a proven framework, enterprise security, compliance tooling, and a managed service backed by ABT and Microsoft.