Closing the Loop: How CFCU Community Credit Union Fixed Its Mortgage Data Disconnect

When Closing Day Wasn’t the End For members, closing on a mortgage should feel like the finish line. At CFCU Community Credit Union, it often felt...

Information Security Compliance

Add security and compliance to Microsoft 365

BI Reporting Dashboards

Realtime pipeline insights to grow and refine your learning operation

Integrations for Banks & Credit Unions

Connect LOS, core platforms, and servicing system

Productivity Applications

Deploy customized desktop layouts for maximum efficiency

Server Hosting in Microsoft Azure

Protect your client and company data with BankGrade Security

3 min read

Justin Kirsch : Aug 18, 2025 9:45:00 AM

For members, closing on a mortgage is a milestone to celebrate. But at Lafayette Federal Credit Union, that finish line used to signal another round of tedious work behind the scenes. After a loan closed in the Calyx Path loan origination system, employees had to re-type the same details into Corelation KeyStone, the core banking platform.

Two systems. The same information. Hours of double work.

It wasn’t just inefficient – it created risk. A mistyped number or missed field could leave mortgage records out of sync, delay onboarding into the core, or trigger a compliance headache down the line. Members who thought their mortgage was complete sometimes waited longer to see it reflected in their accounts.

Based in Rockville, Maryland, Lafayette Federal Credit Union has grown into one of the nation’s top-performing credit unions. It manages more than $2 billion in assets and serves tens of thousands of members worldwide. In 2022, Lafayette Federal converted to Corelation’s modern KeyStone core, consolidating data and enabling tight integration of third-party systems through KeyStone’s open API. The credit union even selected a new digital banking platform largely for its close integration with KeyStone — aiming to give members a modern, seamless experience across channels.

Yet for all these advancements, the mortgage team was still stuck with an inefficiency that technology should have solved: two critical systems that couldn’t talk to each other.

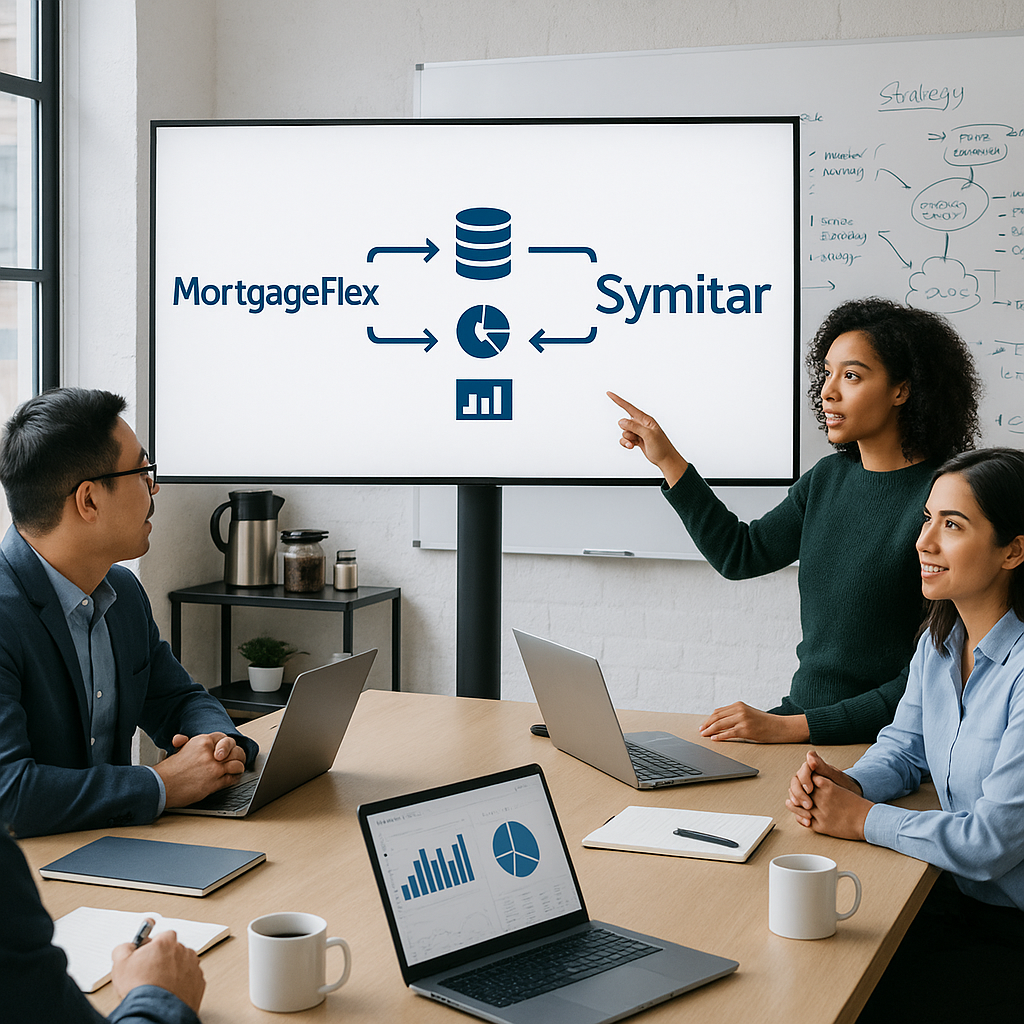

To solve the disconnect, Lafayette Federal turned to MortgageExchange® from Access Business Technologies. MortgageExchange is a cloud-managed integration platform that bridges disparate systems in real time.

Lafayette Federal deployed MortgageExchange to connect Calyx Path and KeyStone, creating a direct, automated data pipeline between the LOS and the core.

Fixing this one bottleneck has had ripple effects across the organization. Employees are no longer bogged down by double work, so they can spend more time with members instead of with spreadsheets. Members enjoy faster, smoother service – for example, seeing their new loan show up in online banking without delay. Compliance and reporting are stronger now that data is consistent everywhere.

In short, by connecting Calyx Path and KeyStone through MortgageExchange, Lafayette Federal turned a tedious back-office chore into a strategic advantage for both staff and members.

Explore more MortgageExchange case studies to see how other institutions are streamlining post-closing and eliminating manual re-entry.

When Closing Day Wasn’t the End For members, closing on a mortgage should feel like the finish line. At CFCU Community Credit Union, it often felt...

For members, closing day feels like the finish line. But inside a credit union, it’s often the beginning of a long post-closing checklist: pushing...

Context & Profile Credit Union West is a Glendale, Arizona-based credit union with roughly 90,000 members and over $1.2 billion in assets. Founded in...